4 Journal Spreads to Help You Create and Stick to a Budget

Hi, Emm from @planwithemm here! You can find me on Instagram and YouTube. Today we’re focusing on FINANCES. Money and budgets can be super scary to think about, but it doesn’t have to be that way. Being conscious about what and where you’re spending is the first step towards financial health. Whether you’re paying off debt, saving for A&O’s summer launch, or just looking for ways to spice up your budgeting, this is the blog for you. Let’s dive in!

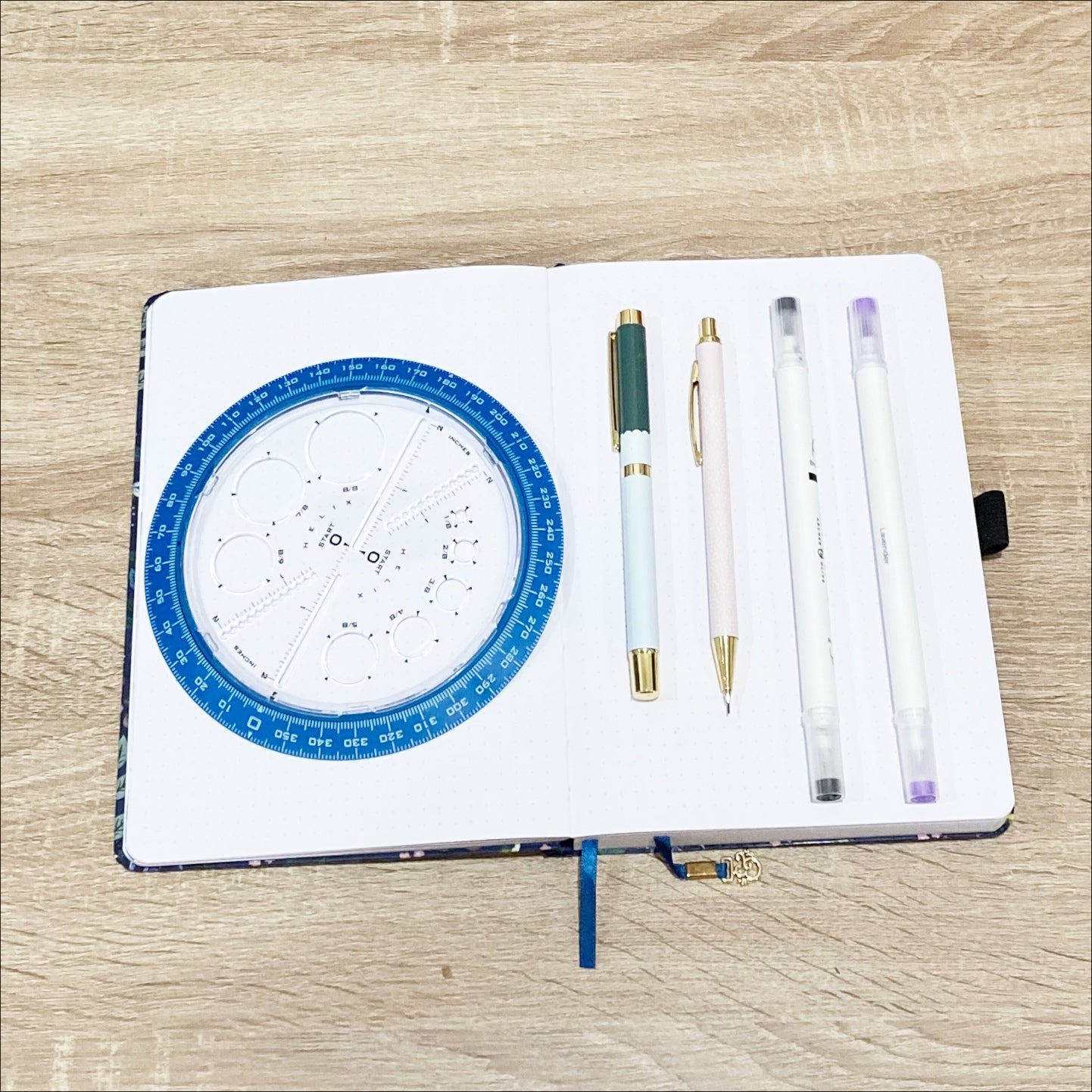

SUPPLIES

- Notebook: I used an A5 size notebook to make sure I had tons of space, but pick whichever size is your favorite.

- Calliographs

- Your pen of choice

- A pencil for any sketching

- Circle maker (optional)

You could also jazz these spreads up with some Washi Tape or Stickers! Make sure to use my affiliate code PLANWITHEMM10 to save 10% at Archer and Olive.

MY APPROACH

You might think that the first step towards budgeting is to look back at previous months and see how much you were spending. For some people that might work, but I follow a more calendar-based approach. What that means is that before making my monthly budget, I look at what I have coming up.

Some examples include

- Events: Hockey games, dinner with friends, escape rooms

- Shopping: Gifts, cards, book preorders

- Appointments: Doctor visits, haircuts

- Travel: Plane tickets, hotels, food, event registration

These are all items that we need to consider on top of our monthly obligations like rent, utilities, debt payments, savings, and other bills. I often find that these “unexpected” expenses lead me to overspend in certain areas because I didn’t account for them in my monthly budget. Taking this moment to assess the month to come can really help with creating a realistic and flexible budget.

BUDGET PLANNING

Got all of your upcoming expenses for the month listed out? Now it’s time to delve into the nitty gritty details. This is when we’ll figure out our budget and relevant categories for the month. Here’s how I personally do it.

- First, take your income and subtract off your required expenses. These are things like rent, utilities, car payments, and other bills and are usually a fixed dollar amount each month.

- Next, I assess my debts. There are many approaches to paying off debt, be it the snowball or avalanche methods. We don’t want to incur more debt or fees if we don’t have to, so we should be making at least the minimum payment on each of our debts. Once you’ve decided on this amount, subtract it as well.

- Then I look at items that are less fixed but still necessary for daily life. For me, this is things like groceries or gas but could also include items like daycare, pet care, or gym memberships. This is when it’s super helpful to look back at previous months to estimate how much each of these items costs. Also remember that for groceries or gas, these expenses occur multiple times throughout the month and we need to account for that!

- Now we’ll look at the items we listed out before as upcoming expenses. This can be a good time to reflect on if some of these expenses are truly things that we want or if they’re from societal pressures. It can suck to have to say no to events with friends, but often you can suggest something that fits your budget like a night in rather than a night out.

- While I consider savings to be super important, it’s listed relatively “low” on the list because I try to be realistic. I would much rather put less into savings than have to constantly dip into it because of expenses I forgot about. However we do want to make sure that we’re progressing towards our savings goals, so try not to skip this step. Every little bit counts!

- Fun money is for FUN! This is things like hockey games, dates with your partner or friends, new A&O launches, and treating yourself. Your budget should help facilitate living, not be overly restrictive.

- Finally, we have miscellaneous expenses. This is for things that truly DO come out of nowhere or don’t fit into any other categories. Sometimes nothing will come up and you can reallocate this money at the end of the month, which is the best feeling.

I’ll often iterate through the last few steps as I construct my budget to make sure that every dollar is going somewhere. If there isn’t much going on in a month, that means more money can go towards debt payoff and savings. But some months are tighter than others and that’s why our systems need to be flexible! This is also a great time to cancel any monthly subscriptions you aren’t using.

In doing my budget this way, I’ve inherently broken my budget into categories. This just works for my brain, but you can sort it however you’d like! For each item, I’ll write it under the corresponding category along with the amount we’ve budgeted for it.

EXPENSE TRACKER

![]()

We can’t just simply write out our budget and hope for the best. I really wish it worked that way though! Expense tracking gives us a chance to check in with our budget, see where our money is going, and adjust. I often find that my dining out allocation gets filled up really fast. Then I can course correct by making some of the dishes I’m craving at home instead of ordering takeout, or doing family style meals like pizza where the cost per person is much lower. A similar concept can be applied for groceries - focus on shopping the sales and using up ingredients that you already have in the fridge, freezer, or pantry to simultaneously reduce spending and food waste.

Alternatively, you might find that you’ve underspent on certain categories and can reallocate those funds elsewhere. Any month where we’re under on utilities feels AMAZING because it usually means that we have a little extra cash to pop in savings. (Also it feels like free money!)

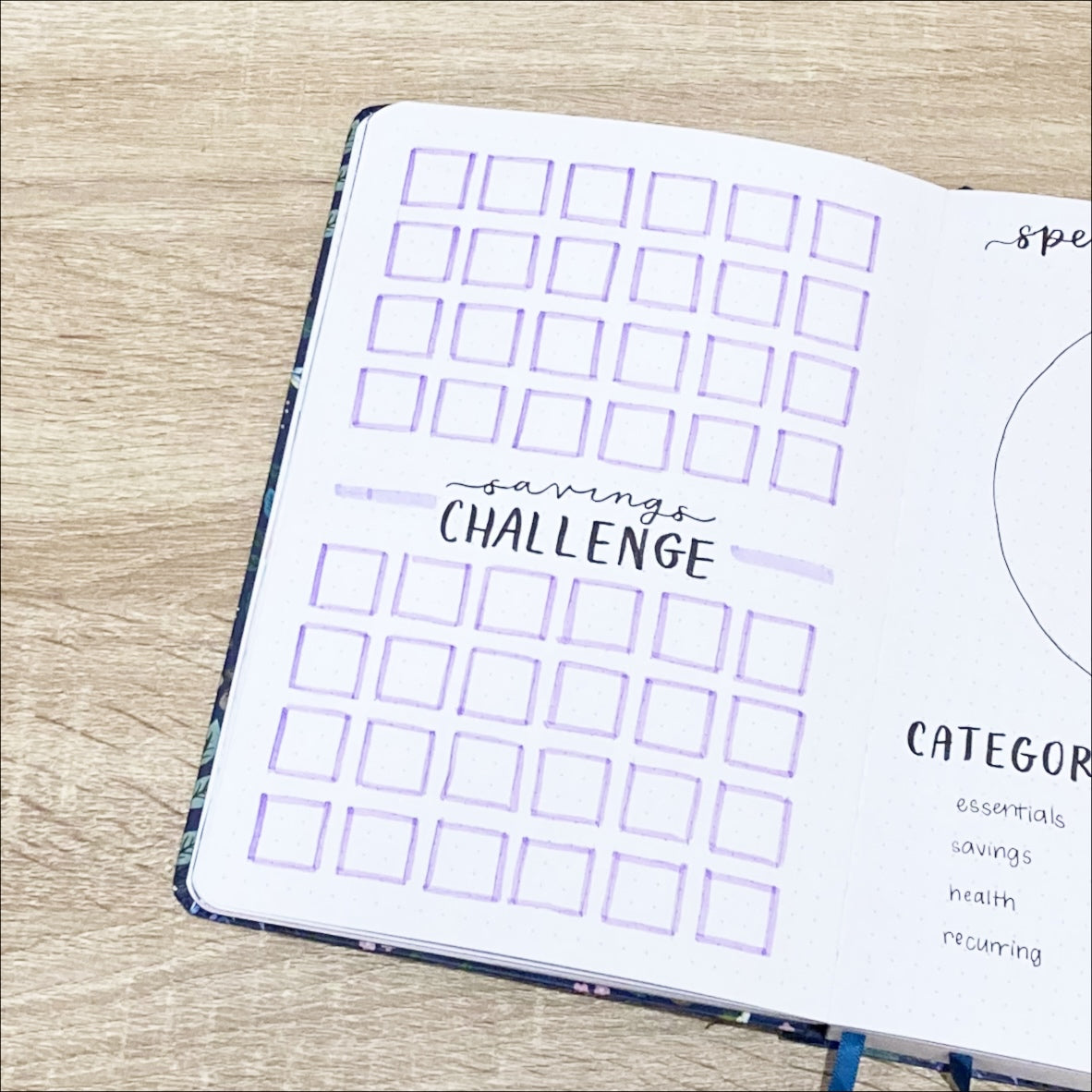

SAVINGS CHALLENGE

We’ve talked about savings, but it can feel vague at times. How much should I be saving? What are we saving for? Do we ever stop saving?

With savings trackers, I find that it really helps to have an end goal in mind. Otherwise you can become discouraged and be tempted to dip into your savings for other fun purposes. It’s worth noting here that I’m considering this savings separately from an emergency fund. Emergency funds are meant for emergencies and unplanned large expenses - like having to replace your tires after a car accident, losing your job, etc. A common rule of thumb is to have 3 months of your salary saved up in an emergency fund. You can split your monthly savings across multiple funds and I’d encourage you to have separate accounts for each event you’re saving for. Usually your bank will allow you to create these online for free.

If you have your savings account set up, now it’s time to actually SAVE! And you can bet that we’re going to gamify it, because nothing feels better than shading in boxes in a tracker. There are so many different types of savings challenges from the 52 week money challenge to the 100 envelope challenge, or even just a simple no spend. You can decide what kind of savings challenge you’re doing and label the boxes accordingly.

For a trip, we could break down our savings tracker into subcategories and purchase each segment (plane ticket, hotel, etc) once we’ve saved enough. Another savings method is a sinking fund - Here you estimate the total amount that you’ll need, divide by the number of months until the event, and contribute that amount monthly. This is often used to save for holiday gifts throughout the year.

Once we’ve figured out the amount for each box, let’s get to filling in this tracker and saving!

END OF MONTH CHECK-IN

We’ve made our monthly budget, tracked our expenses, and saved a little bit, now what? This is quite possibly my FAVORITE part because it summarizes your month and spending data visually. Based on the totals that we spent, we can calculate what each category makes up as a percentage of our income. This can be really eye opening depending - maybe you’ll find that you’re spending 5% of your money on groceries and 10% eating out! Based on these percentages, pick a color for each category and fill in that proportion of the circle. You can totally eyeball this and write down the exact percentage next to the category. I can't wait to see my little budget rainbow!

We can use this tracker to make decisions for next month’s budget and evaluate our spending habits. Remember though that these are all based on estimates, so don’t beat yourself up if you’re not perfectly on budget.

If you want to try out some of my budget spreads in your journal, I’ve created printables of each for your budgeting pleasure.

And voila! We now have 4 spreads that can help us in our journey towards financial wellbeing. Try to make time weekly to check in with your budget and take notes about what works and what doesn’t. Your finances are inherently personal, so pick and choose ideas that will fit into your process. I’d love to hear what you’re incorporating into your systems, so be sure to leave a comment! You can also check out the associated YouTube video for these spreads and check out this blog for more budgeting inspiration.